Big Data in Banking – It’s High Time To Cash-in on Big Data

Big Data is modernizing the world and it has left no industry with its huge benefits. It has appeared as a lifeguard for the Banking Industry. Big Data has saved a lot of revenues from the banking companies so far and has a lot more to offer in the coming years. It gives them a sigh of relief as running a banking company is not as simple as it looks. Big Data in the banking industry helps banks in dealing with the risk, detecting frauds, and in the satisfaction of customers.

This part of the tutorial will give you an understanding of how Big Data is saving millions of dollars for some of the biggest banks in the world.

Applications of Big Data in Banking Sector

Below are a few applications of Big Data in the Banking sector-

- Risk Management

- Fraud Detection

- Customer Satisfaction

Here is a detailed explanation of Big Data’s description in the banking sector.

1. Risk Management

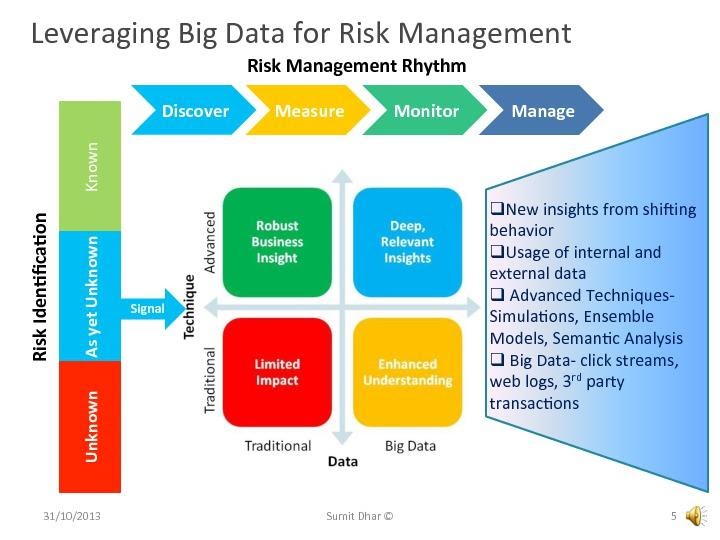

Launching a strong risk management system is of the greatest importance for banking organizations or else they have to experience huge revenue losses. To survive in the competitive world and increase their profit as much as they can, organizations have to keep updating new things. During Big Data Analysis, firms can detect risk in real-time and saving the customer from potential fraud.

Big Data in Banking Case Study – Risk Management

UOB Singapore

The United Overseas Bank (UOB) Limited, the third-biggest bank in SouthEast Asia, has used Big Data to maximum advantage to direct risk management, the major area of worry for any banking organization.

Keeping the same in mind, UOB took a chance with employing a risk management system that is based on Big Data. Estimating the value of risk is a time taking process, usually taking up to 20 hours. Through its Big Data risk management system, UOB was now able to do the same task in just a few minutes and with an idea of doing it in real-time very soon.

2. Fraud Detection

Below is the second application of Big Data in the Banking sector – Fraud Detection.

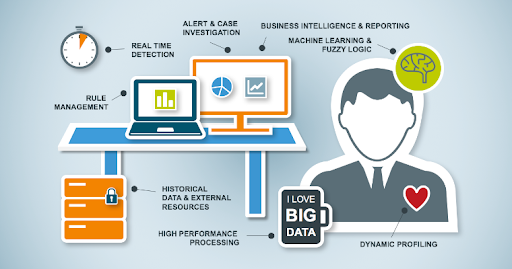

The swiftly growing digital world is providing us with several benefits but on the other hand, it is also the beginning of various kinds of fraud. Our data is now more exposed to cyber-attacks than ever before and it is the biggest challenge a banking organization encounters. Utilizing Big Data Analytics with some Machine Learning Algorithms, organizations are now able to detect frauds before they can be placed. This is done by identifying unusual spending patterns of the user, forecasting unusual activities of the user, etc.

Big Data in Banking Case Study – Fraud Detection

Danske Bank

Danske Bank, with a customer base of more than 5 million, is one of the major banks in Denmark. The bank is under pressure with its fraud detection methods having a very low percentage i.e. merely a 40% fraud detection rate and managing up to 1200 false positives per day. This was a disturbing rate for them and immediate action was required.

Danske Bank then decided to join hands with Teradata, a leading database and analytics service provider company, to make use of some advanced Big Data analytics for improving their fraud detection techniques and soon observed some generous results. The bank observed a 60% reduction in false positives, expecting it to soon reach an 80% mark and an increase in the true positive rate by 50%. Danske Bank also saw a massive operating profit of $70 million in 2018.

This is how Big Data analytics provided support to the trailing Danske Bank.

3. Customer Satisfaction

Let’s have a look at the third application of Big Data in Banking industry – Customer Satisfaction.

Bearing in mind the high amount of risk involved when you deal with the banking firms, to guarantee the satisfaction of a customer is one of the most challenging tasks for them. From guaranteeing the safety of their transactions to providing them the most important and beneficial offers, customer retaining is a lifetime journey for the banking companies. The data that they collect from their customers is now more important than ever. Evaluating their customer’s data based on various parameters helps them in directing their customers in a much better way.

Big Data in Banking Case Studies – Customer Satisfaction

Here are the two case studies of Customer Satisfaction –

· JP Morgan Chases Big Data

· Bank of America Big Data Case Study

A. JPMorgan Chases Big Data

JPMorgan Chase and Co. is one of the biggest banks in the United States and the sixth-largest in the world. Moreover, it is the world’s most valued bank in terms of market capitalization. With a customer base of over 3 billion, the volume of data it generates is unbelievable including a huge amount of credit card information and other transactional data of its customers.

They have implemented Big Data technologies, mainly Hadoop, to handle this data. By using Big Data Analytics, they are now able to create insights into customer trends and the same reports are presented to its clients. They can evaluate a customer separately and these reports are generated within seconds.

B.Bank of America Big Data Case Study

This is another Customer Satisfaction case study of Big Data in the Banking sector.

Big Data rescuing The Bank of America

Bank of America is one of the biggest banks which is located in the United States. It has a customer base of around 70 million. In the year 2008, they recognized that their customer base was decreasing at a startling rate as they observed their customers shifting towards smaller banks. This left them clueless and they were dreadfully seeking the reasons for this sudden downfall.

Big Data Analytics then came to their salvage. Through evaluating their customer’s data from different sources such as their website, call center records, and personal feed backs, they detected that their end-to-end cash management system was too rigid for the customers as it stalled their freedom to access simple and flexible cash management system. Though smaller banks were offering a painless solution to it. Eventually, they decided to end their all-in-one offering.

Soon in the year 2009, as a solution to these problems, they launched a website that was a more adaptable online product, CashPro Online, and its mobile version, CashPro Mobile later in the year 2010. This was created to provide its customers with a one-stop solution for all the services they offer.

Conclusion

With huge volumes of data comes endless opportunities for all kinds of businesses across different domains to explore that data, and the banking sector is amongst the most profited ones. The data that the banking firms collect is as crucial and as valuable as anything else for them.

Banking firms have now understood the value of their data and are taking advantage of it. Data is like second money for them. Big Data analytics has been the mainstay behind the revolution of online banking in the industry. It is now an essential part of the biggest banking firms across the world. Big Data analytics has now inspired them to save millions which previously seemed impossible to them.